Tutorial: How to plan a venture capital funding ?

In this tutorial, we need to define keywords, because even if you have not already the new venture capital app "simulfund*term sheet & funding", you can read and understand this tutorial.

How to define the expression "venture capital" and how to plan a venture capital funding?

Venture capital is the ability to invest in best Startups and predict the market trend. To summarize, venture capitalists are those who have enough common sense to detect changes before trends become apparent in the economy.In the field of venture capital, a Startup is a newly created business or a small business with high sales previsions and generally seeks equity capital to support its growth.

Venture (i.e.,risky businesses) - Capital (i.e.,Assemble essential long-term resources and knowledge).

The risk in venture capital, for example, is to invest in innovative companies that are too small and do not have enough capital or experience to grow, or to lose the money invested because of the management, regulations, rules, technologies, etc... But the risk also implies a high growth potential and a high profitability.

Take the example of an innovative Startup that raises funds by selling new shares issued to a new Investor, and see how the capitalization of this Startup is impacted.

In this prospective simulation to plan a venture capital operation, we assume that the founder currently holds 88% and the other shareholders 12% of the shares. For the transaction to be simulated, we assume, the Leader is ready to offer about 30% of the company's stock.

What does it mean if the venture capital Investor is willing to invest his money in new shares issued by a Startup?

First of all, one of the most important steps to fix before the funding is the pre-money valuation of the Startup. The "Pre-Money Value" means the valuation of the company before the Investor is injecting his money in the company cash-flow.

The Pre or Post-Value is calculated as follows to perform simulations:

The "Pre-Money Value"= (numbers of the company's shares) x (the price of a share of the company).

The "Post-Money-Value"="Pre-Money Value"+ (the amount invested in the company by the investor).

To be sure that when the business starts to grow rapidly, all the necessary skills continue to work in the company. The venture capitalists could want to define an option pool. Generally not yet issued, the "Option Pool" is an equity reward for consultants, directors or other key employees.

Calculated with the post money valuation, If the "Pool" is too high , the current stockholder is diluted and if the option "Pool" is too small, it may be difficult to maintain the human skills that can contribute to the success of the business.

The "Funding Needed" or the amount of financing needed for the company could also be discussed by investors. If the amount invested is less than the needs, in this tutorial, it may be interesting to see what happens next with a new simulation.

To make this tutorial more fun, we will plan fictional scenarios using the Simulfund app to illustrate how these mechanisms work.

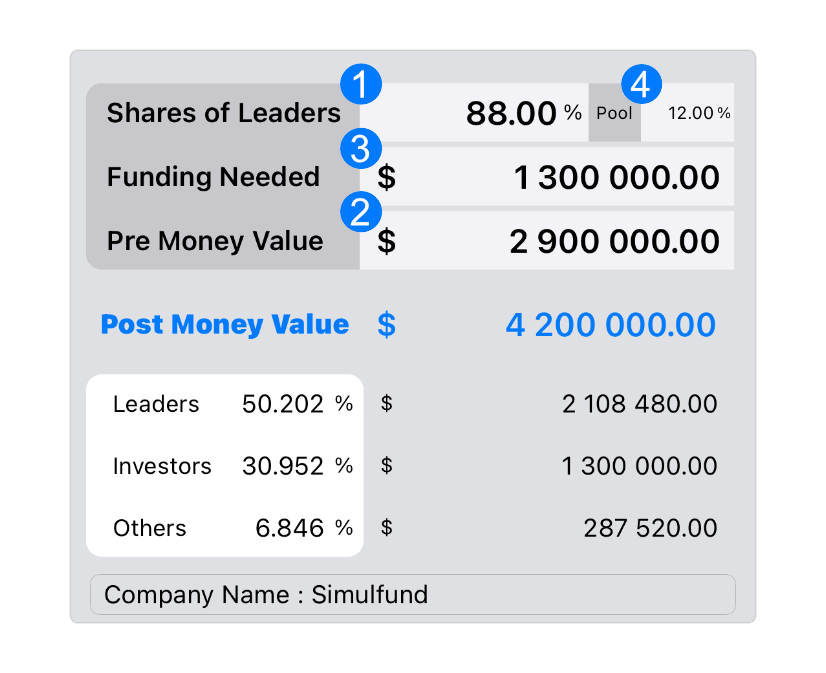

Case 1: Assume that the Founder / Leader of the company is fixing his offer to venture capital investor like that:

- The Shares owned by the Leader of the company: 88%.

- The "Pre-Money Value" at $2,900,000.

- The "Funding Needed" of the company at $1,300,000.

- An "Option Pool" at 12%.

With these data, the Simulfund app gives a post-money valuation of the company at $4,200,000, the percentage of shares for the Founder / Leader is now 50.2%, the others 6.8% (before 12%) and the Investor gets 30.95% of the Startup's stock for $1,300,000.

Imagine now, that the Investor wants something different, and proposes to invest less money than the company requires.

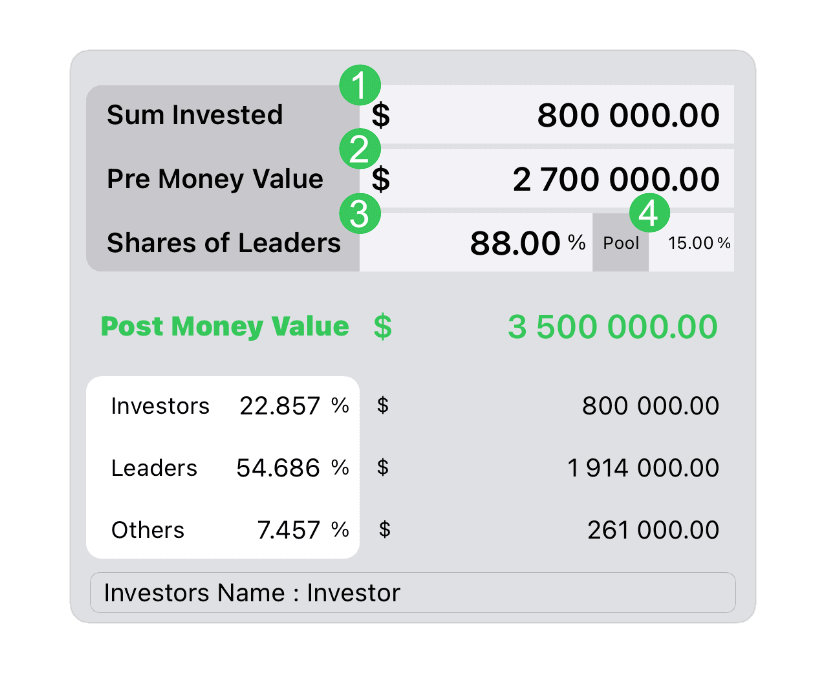

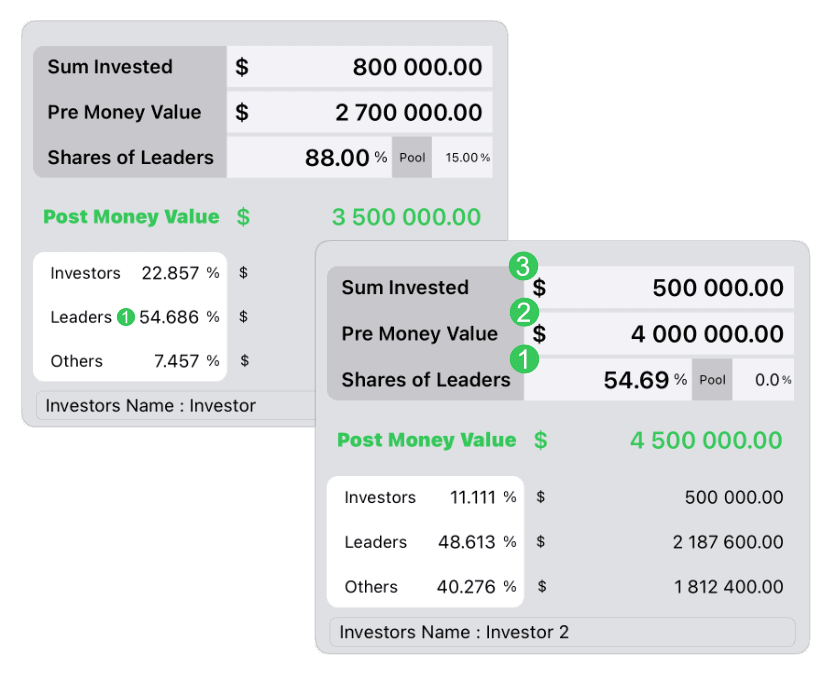

The Investor defines his preferences as follows:

- The Sum of money invested in the company $800,000.

- The "Pre-Money Value" of the company at $2,700,000.

- The shares owned by the Leader: 88%.

- An "Option Pool" at 15%.

A more detailed inspection on a fully diluted basis, shows that the leader's stock percentage is higher, but the sum invested and the pre-money value is lower than before. This means that the valuation of the company's shares will also be lower.

The dilution due to the new shares issued by the Startup means a loss of the ownership percentage for the benefit of the current shareholders, but it could also produce a higher valuation for them: it often depends on the price of the company (pre-monetary value) and the sum invested.

Suppose that the parties accept the transaction proposed by the investor in (2).

Before the deal, we suppose that when this company was created, the nominal valuation was $100 000 and holding 88% of the shares means that the shares have a value of $88 000 and the other shareholders ("Others") own 12% for $12 000.

Is it good for current shareholders and how to see it?

After the transaction, the "Others" shareholders are diluted and now have 7.46% for $261 000. As a result, the valuation of the shares has increased by 2 175%. That's a lot, but in reality, it's very difficult to realize such strategies in venture capital operations.

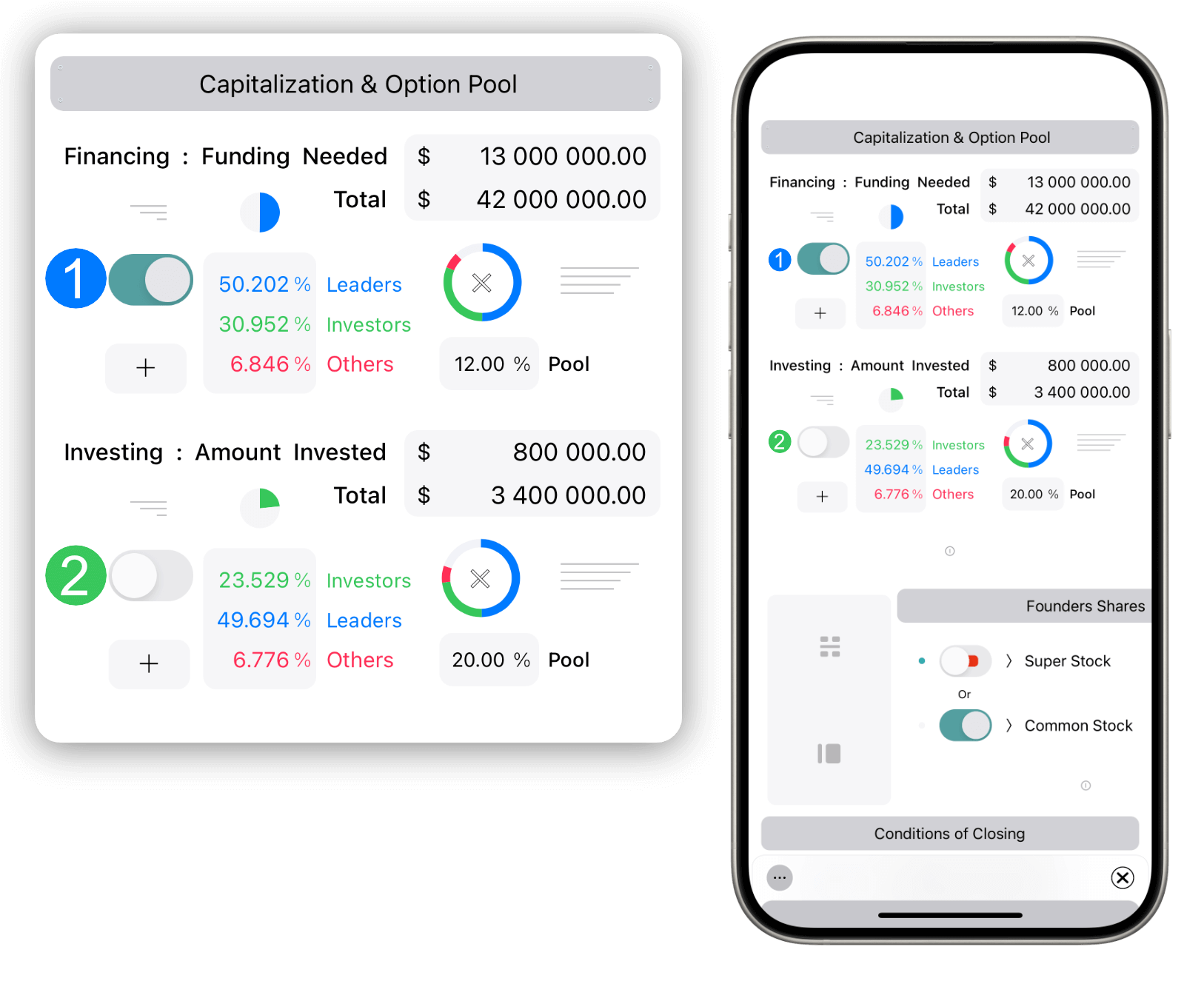

Finally, we can compare these simulations to see how the different approaches affect the Cap Table of each party:

(1) For the Leader, the company’s pre-money valuation is greater than the Investor is willing to pay to buy the company's shares.

(2) For the Investor, the option pool should be larger and the amount that can be invested is less than the company's "Funding Needed".

To make this tutorial more complex, we can now plan a new venture capital funding simulation with a new investment, to see how to manage this new deal.

Case 2: let's continue to speculate on this venture capital simulation because the company needs $500,000.00 more to complete its "Funding Needed" $ 800 000 + $ 500 000= $ 1 300 000.

But, assume that the new investor wants to invest on a fully diluted basis, this means that the previous Option Pool not yet issued will be taken into account to calculate the new ownership percentages.

And now:

- The Leader of the company owns 54.69%*.

- The pre-monetary value is fixed at $4,000,000**.

- The Sum Invested by the Investor is $500,000.

* Before it was 88% and without the Option Pool, it would be 67.89% instead of 54.69% for the Leader's ownership percentage.

**You may find that the new pre-money value of the company is higher than the previous post-money value, we therefore assume that shares have a better valuation, mainly because of the previous investment.

The situation described in Scenario 2 works well if you plan to raise funds from multiple investments with business angels or venture capitalists, for example. The risk is to lose a slightly higher percentage of ownership stakes to each round, but compared to value created, this could be considered carefully.

Unless you are dealing with inexperienced investors, the professional venture capital investors often come up with terms they think are fair before investing their money.

In any case, if you are the Leader of a Startup, it could be highly recommended to anticipate before raising money, by preparing, for example, your own simulations to make sure you have something to submit to potential investors.

In this tutorial: How to plan for venture capital funding, it may be important to talk briefly about the term sheets and provisions by consulting some of them to understand, how they might work.

A venture capital term sheet is a binding or non-binding contract or draft containing terms that the parties plan to sign to finance the business.

Important: if you are not a professional and you read this tutorial because you plan to start negotiate a term sheet, it is strongly recommended that you seek the advice of counsel in the relevant jurisdiction.

What types of venture capital terms could be used in some cases by investors to secure a capital investment?

First, there are many terms used by a venture capitalist to ensure that the Startup will be in the path of the success. For example, we can simulate scenarios to imagine how to deal with some issues that could prevent some Investors to put their money or trust in the project.

If you are not experienced, remember that this tutorial is for informational purposes only and may not be completely relevant to your particular case.

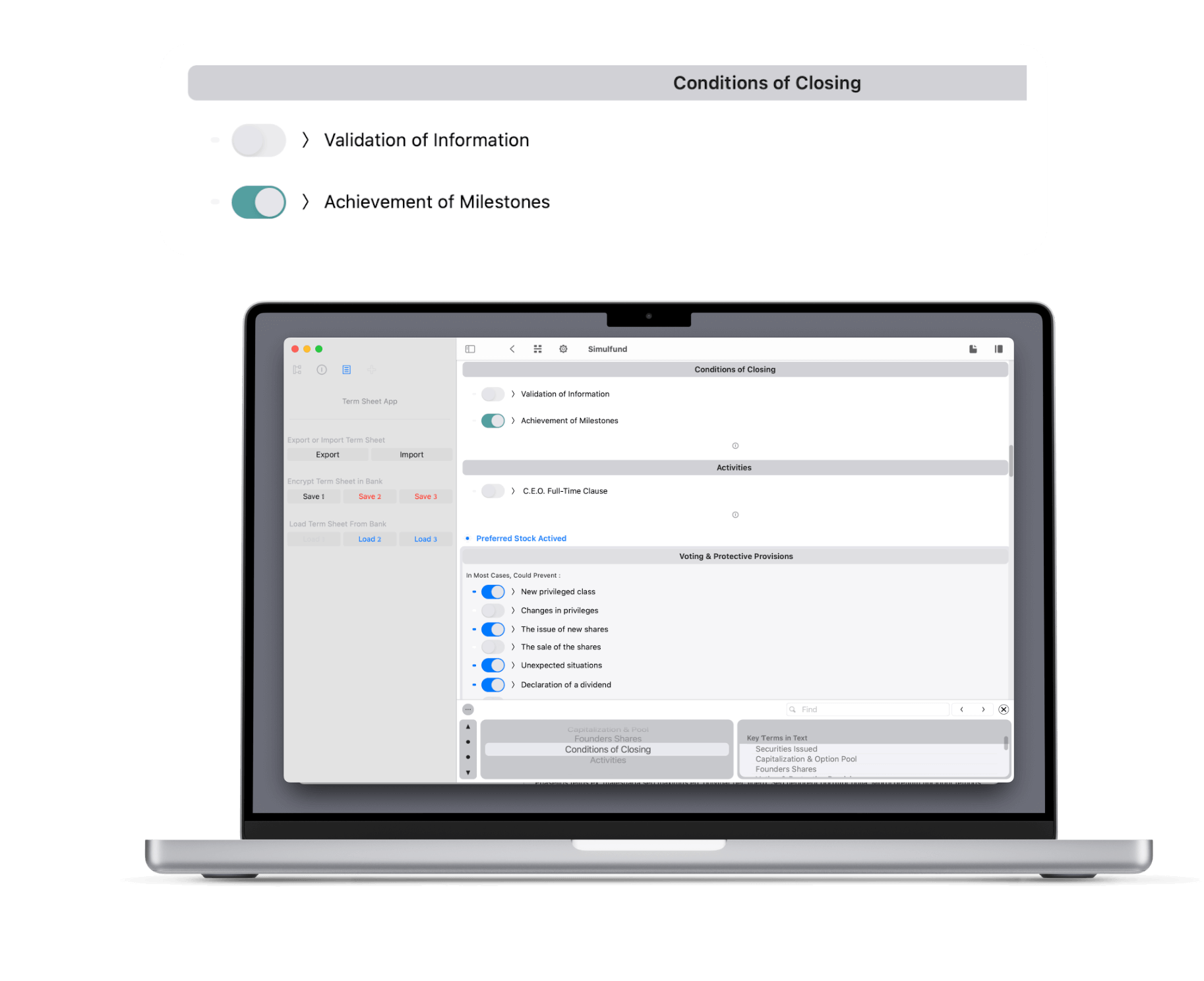

A. To limit the risk of a funding, professional Investors could plan a road map with steps to ensure that the investment is well managed.

Setting strategic goals and reaching them, could boost the relationships with investors and put the Startup in a good position for a future equity funding. Instead of investing less money, a professional investor could draft a milestone clause to limit the amount invested according to the actual results. Over time, trust in the company management and its activities will increase.

For a Leader of a Startup, it could give a chance to prove his ability to convert an investment into real values for the Investors and shareholders. This could generate less stress for the organization, which may need more capital to move to the next step.

On the other hand: we have already seen in case 2 that, when the Startup gets its necessary financing in multiple rounds, the evaluation could be higher for the current shareholders as well as the dilution of their ownership interests.

This is why the equity investors always plan to purchase the stock when the company is started or when it is not yet created (not yet created as a company). With their knowledge, time and expertise, the best venture capitalists* of the world often success to benefit from lower valuation and a better profitability when they exit.

*The trick: they are really trying to help to safely develop Startup's sales, staff and innovation with the help of the original founding team, as much as possible.

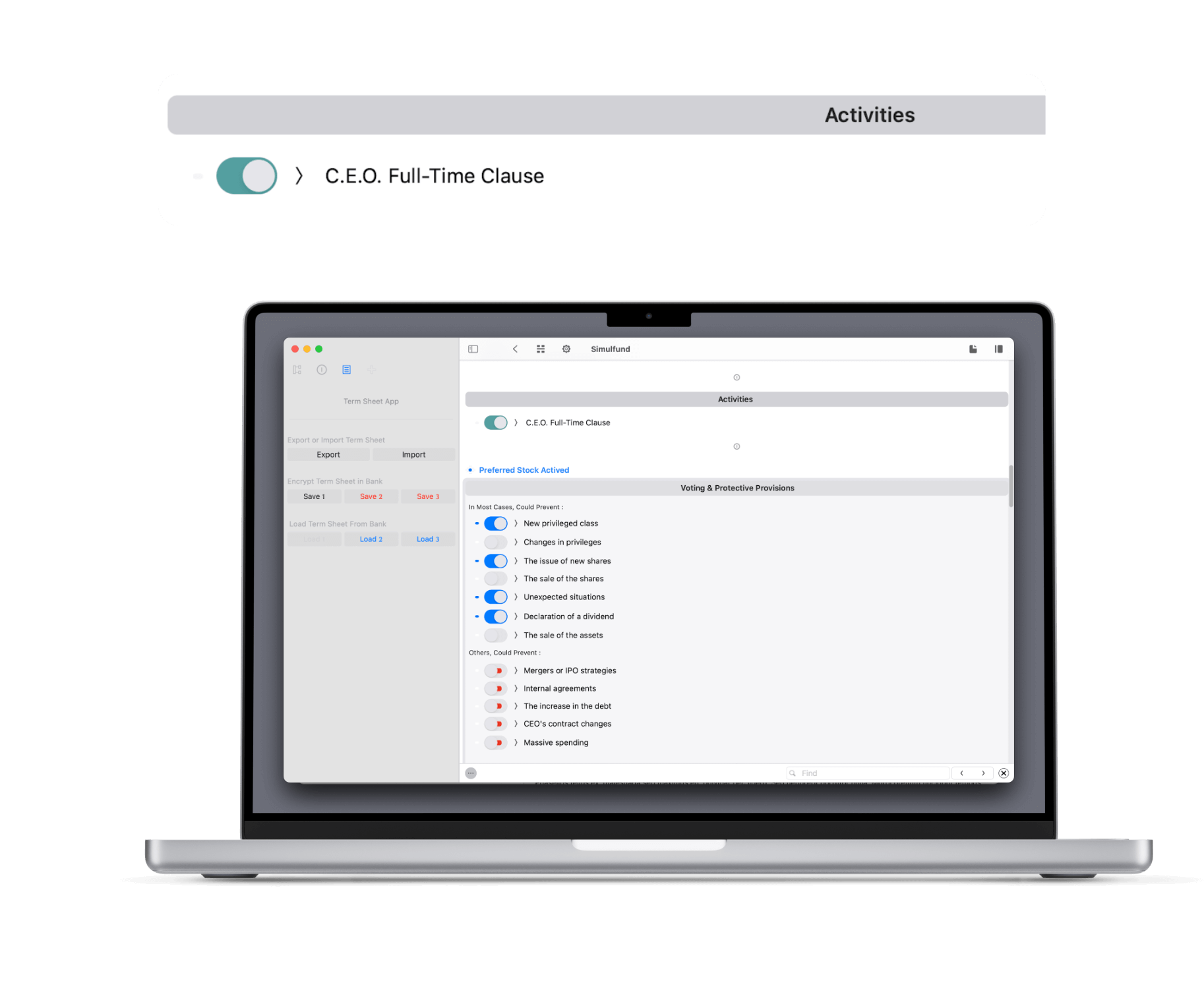

B. In case an investor would diagnose that a Leader cannot concentrate on his job due to many other activities, how could he solve this problem ?

Let's talk about the activity of the CEO, imagine that the agreement is signed and that the CEO has a great new idea or that he currently has other responsibilities that require time. As a result, he will spend less time managing the recently funded project.

Depending on the situation, it may be important to solve this problem for investors and cover this risk before investing.

All expert entrepreneurs know that it is very difficult to start a new business and make it a success, even if you have unlimited funds. Delivering value simultaneously to the company, current shareholders and the prospected market require time and attention. Thus, a part-time CEO might be a bad idea to achieve this goal at the very beginning of the Startup's development.

That's why this provision can be offered by professional investors to ensure that the company has an effective Leader who manage the corporate strategies with the board of directors.

Disclaimer : All information in this article is for general informational purposes only and does not constitute legal advice in any respect. Please review the terms of service on this website that should apply to you when you are using this website.

The Best venture Capital App Just For You

Almost everything you need to simply decrypt, create or negotiate a venture capital operation or financing with friends & family.